Understand control accounts in bookkeeping

No products in the cart.

What is internal control?

Internal control is a process designed to minimize risks and safeguard organizations to achieve their objectives and to set goals.

Therefore, the management set internal and ensure the others in the organization understand and stop making errors.

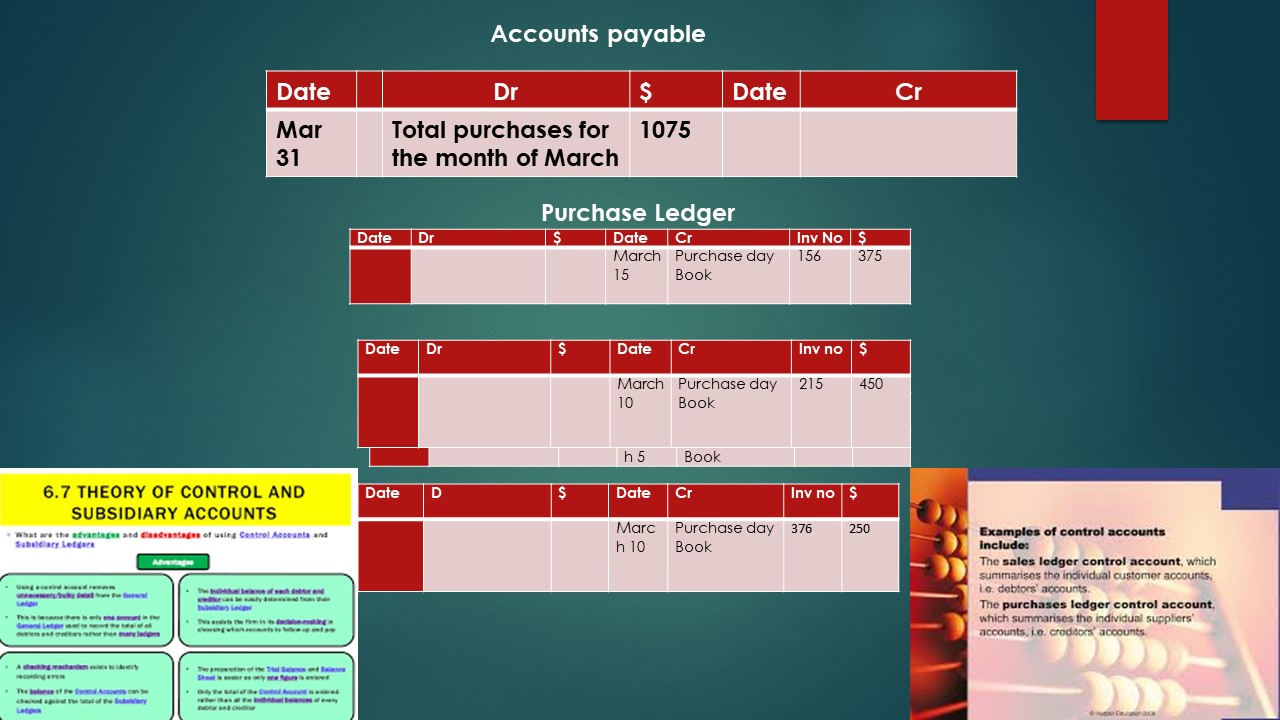

Will enter goods sold on credit in the sales ledger as a debit becomes the accounts receivable, and the credit goes to the income account in the ledger account. Therefore, the accounts receivable shows the balance owed by customers at the end of the financial year.