Why do businesses run out of cash?

Some start a business with little money, and it runs out quickly, and they do not have any other way to find money and get stuck there and ultimately leave the business. That means they have lost what they had in their hands and end up with nothing.

One of the reasons is they overspend on unnecessary things irrelevant to the business and run out of cash.

Overstocking

Then buy stock and leave it in the warehouse without monitoring it. They fail to realize not all the stores will bring in enough sales; therefore, they do not buy such stocks.

When they make a mistake like that, instead of leaving the stock there, they should give a price reduction and sell it to recover the loss. In this way, your customers will become interested in your business as they get extra benefits which help in the long run.

Then business owners do not have enough knowledge about the business that they want to start and end up making many mistakes. Before you start any business, you must learn the nitty-gritty of running a business to save you from unexpected disasters.

Pricing

People make mistakes in pricing, and they lose sales; if the price is high, they will not have enough sales, and if the price is low, you might have sales and less profit. Therefore, pricing ensures you get enough income for your business.

Sell the wrong product.

You must check whether you will have buyers when you produce a product. Finding out the customer’s problems and ensuring you can solve them is vital. If you have a product that your customers want to buy to solve their problems, you will not run out of sales.

Business plan

When a start-up does not have a business plan, cash flow, and budget could affect your business in many ways and never be able to grow your business. If you have a business plan, you must follow it properly to take your business in the right direction; otherwise, it will lead you to the wrong path without even realizing your mistakes.

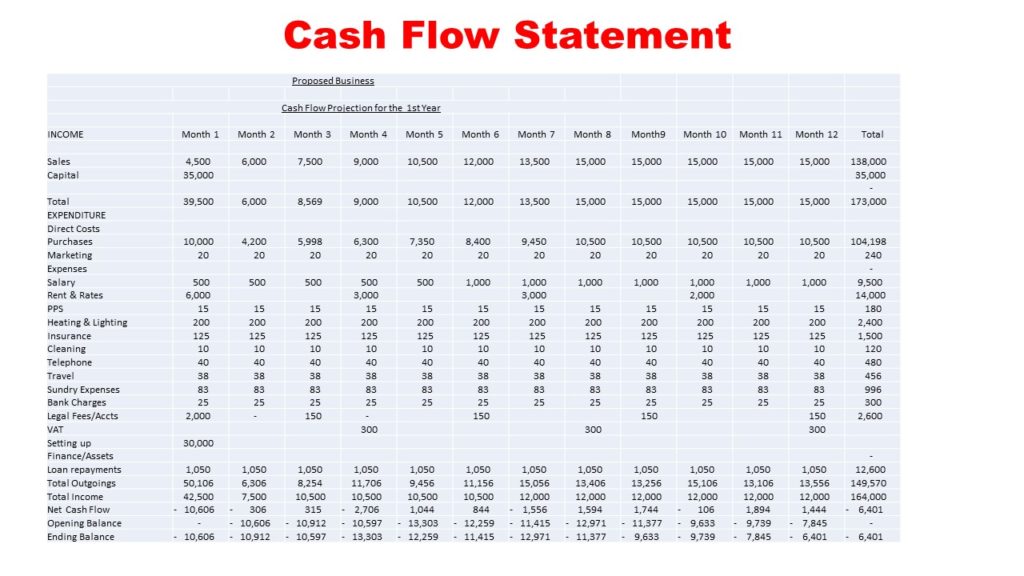

Cash flow

Then if you have a cash flow, it shows the money that goes out and comes in daily if you monitor it properly. So, at the end of every day, when you check your cash flow, if you see a negative cash flow, you must rectify the shortage the following day by following the expenses and the income of the business. If you keep getting a positive cash flow, it will help you put that money into your savings so that you can use it if you need cash for your emergency.

Budget

Setting a budget that suits your business is vital because you can keep your expenses under control. If your business shows a negative budget, you must check your costs and eliminate unnecessary expenses. Therefore, always ensure that you have a balanced budget.

Further, some businesses make mistakes by allowing anyone working there to handle cash. Errors or fraudulent activities could occur and make you run out of money.